Federal Reserve Makes No Change to Interest Rates, Meaning Bidenomics is Still Driving Stubbornly High Inflation

WASHINGTON, D.C. – Today, the Federal Open Market Committee (FOMC), the Federal Reserve’s (Fed) committee that meets every six weeks to discuss federal interest rates, announced that there will be no immediate change to interest rates.

Chairman Arrington on our Current Economic State:

“Democrats and President Biden have made history for all the wrong reasons: record $7 trillion in additional debt, a record number of regulations by a President, and 40-year high inflation.

It’s no wonder GDP growth is stalling, consumer confidence is faltering, and the Federal Reserve won’t be dropping interest rates anytime soon, which will only perpetuate the cost-of-living crisis and put the American Dream of home ownership farther out of reach for hardworking families than ever before."

Americans can’t afford four more years of this Administration.”

Plummeting Consumer Confidence:

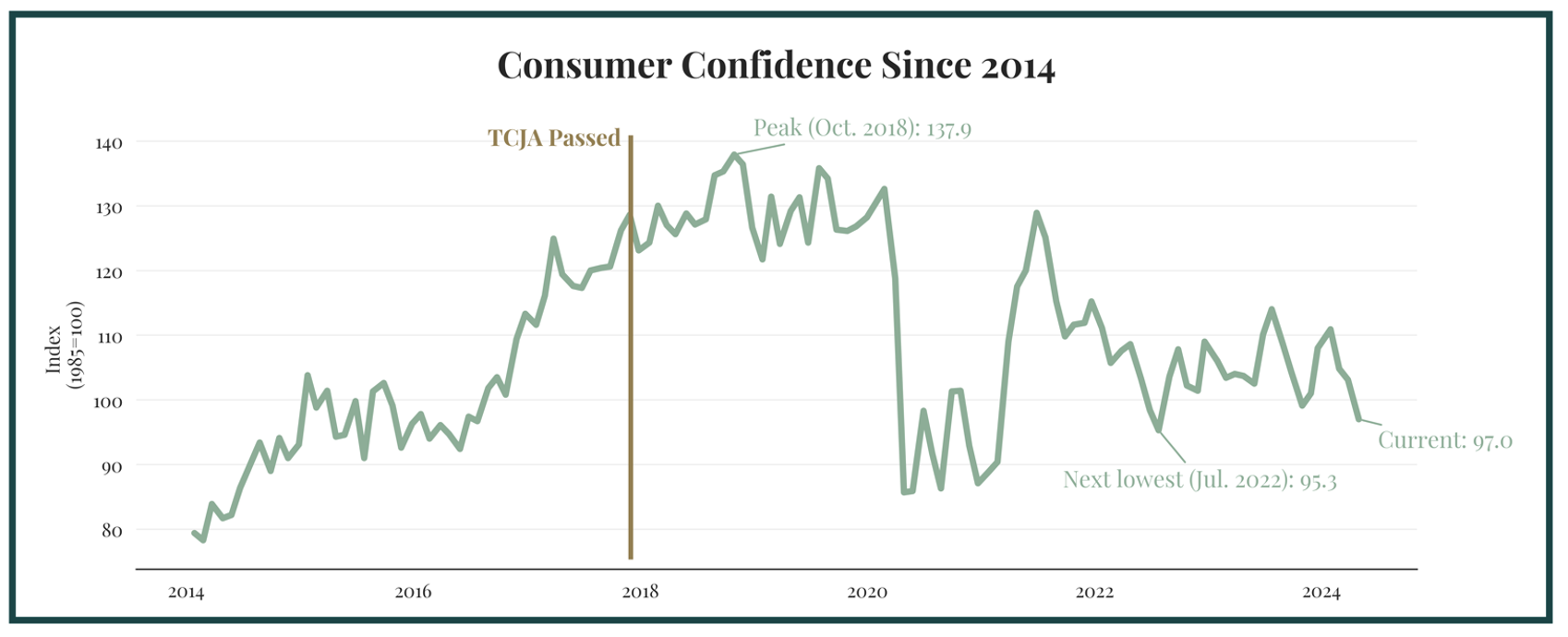

- In April, Consumer Confidence fell for the third consecutive month, reaching its lowest level since July 2022.

- Consumers have become more pessimistic about both the present economic situation and their near-term expectations. The expectations index continues to signal an upcoming recession.

- The index fell to 97.0 this month (April), down from 103.1 last month (March).

- This is another nonpartisan economic outlook reaffirming that consumers are still feeling the pain of high inflation and interest rates.

- Combined with last week’s GDP report, which shows just a 1.6 percent rise, this paints a negative picture of the current economic situation.

Alarmingly, this is the third consecutive monthly decline to its lowest ebb since the post-pandemic recovery began. The latest reading This isn't just a statistic; it's a resounding vote of no confidence from the American public in the economic direction under President Biden. It signals a stark pessimism that can herald a looming recession.

Stubborn Inflation Caused by Biden's Spending:

- Inflation peaked at 3.5 percent in March, the highest in the past six months.

- Inflation has increased a staggering 18.9 percent since January 2021.

The Administration’s spending spree is clearly to blame for stubborn inflation. Each percentage-point rise in inflation acts as a stealth tax on American families, eroding their hard-earned income. This isn’t just poor fiscal policy—it’s fiscal irresponsibility on an epic scale.

Stagnant GDP Growth:

- GDP growth limped in at a meager 1.6 percent for the first quarter.

- This was well below estimates from market watchers, with outside experts forecasting growth as high as 2.9 percent.

Under the Biden Administration, unbridled spending and failed economic policies have created these slow growth conditions.

The Bottom Line:

The House Budget Committee is sounding the alarm on the dire economic indicators emerging under the current Administration, which starkly illustrate the failure of its fiscal policies. House Budget Committee members are deeply concerned by the troubling trends in consumer confidence, stubbornly high inflation, and sluggish GDP growth, signaling a clear mismanagement of the economic stewardship of our country.

More on the Economy From the House Budget Committee:

Read Chairman Arrington’s statement on the March inflation rate coming in at 3.5 percent HERE.

Read Chairman Arrington’s statement on GDP rising by 1.6 percent for Q1 of 2024 HERE.

Read Chairman Arrington’s statement on Consumer Confidence for April falling to the lowest level since July 2022 HERE.